Last night, defeat settled in for me regarding Satoshi’s vision. Here’s why I feel that way.

Satoshi’s vision for Bitcoin was to be adopted by everyone with a device and access to the internet, which will be almost every individual on earth by the end of this century. Fast cheap secure transactions for everyone, regardless of geographic location or state citizenship. It was to usurp the existing financial institutions and regulatory regimes, which would slowly crumble under their own weight as Bitcoin’s ease and efficiency would be overwhelmingly preferred by the entire world.

That has now been spoiled. The efforts to halt any block size increase has successfully hamstrung bitcoin into providing slow, expensive transactions. This has bought time for the regulatory state to catch up to Bitcoin’s success, restricting people’s access to the currency and tying their wallets and transactions to their identies via KYC requirements. Governments are notoriously slow to react to ideas that threaten their power, so this precious time has allowed them to step into the market. The Segregated Witness/Lightning Network protocols will take at least a year to produce the desired effect of increasing capacity and lowering transaction fees, and that’s not even a guarantee. So this buys governments even more time. Bitcoin’s stagnation has and will continue to allow governments to enact more restricting controls over the currency.

This really began with Satoshi’s disappearance, which itself was caused by the state. States demanded that banks stop servicing Wikileaks, which made them desperate for funding. Julian Assange turned to Bitcoin in 2010, against Satoshi’s wishes. Satoshi stated that “the heat they would bring would likely destroy us at this stage”. When a major article was published denoting how Wikileaks was using Bitcoin to fund their operations, Satoshi disappeared, saying little more than “the horde is coming”.

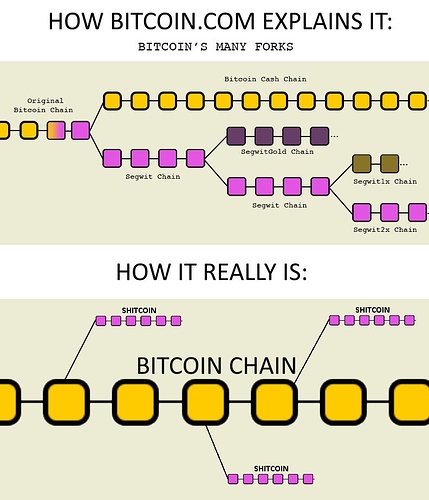

So now with a third and possibly fourth Bitcoin on the way and a fragmented community at war with itself, how do adoption rates continue to rise? How does a newcomer who’s told by several different people, “Don’t use their bitcoin, use my bitcoin” make a decision? How do they do most of their economic activity in Bitcoin when it’s not economical to do so?

Now that the regulatory regimes of the world are catching up, Bitcoin is no longer a solution to their monopolistic power. At best, it is simply a new “asset class”, to be traded next to oil, silver, and grain. Satoshi’s vision is dead.